Apache is functioning normally

As if you needed more evidence that it’s not a good time to buy a home.

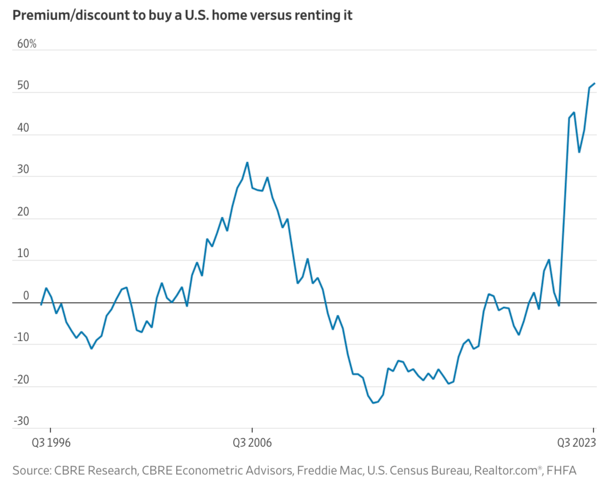

The latest piece comes from the WSJ, which revealed that renting is 50% more expensive than buying.

This comes on top of a recent Fannie Mae survey that said home buyer sentiment matched an all-time survey low, with only 16% indicating it was a good time.

The culprit continues to be mortgage rates, which surpassed 8% last week and continue to erode affordability.

So is it better to hold off and keep renting or continue to house hunt?

It’s Not Always a Good Time to Purchase a Home

First off, it’s not always a good time to purchase a home, or condo for that matter.

Ultimately, there are better times and worse times, at least if we’re framing the question in terms of investment returns.

There’s also the sheer matter of affordability, which could jeopardize the transaction long-term if the buyer isn’t able to keep up with payments.

That’s essentially what transpired in the early 2000s, when home buyers with no business buying homes went through with the transaction regardless.

Often, this involved some creative financing and perhaps some stated income underwriting to get to the finish line.

In the end, while they qualified for the loan and closed on the purchase, they often didn’t make it past the first few mortgage payments before they fell behind.

Today, the situation is different because many of those questionable loan types, like stated income loans and option ARMs, no longer exist.

You can thank the Ability to Repay/Qualified Mortgage rule (ATR/QM Rule), which was born out of the prior mortgage crisis.

It requires lenders to “make a reasonable, good faith determination of a consumer’s ability to repay a residential mortgage loan according to its terms.”

That’s good news because it means fewer unqualified home buyers are getting approved for mortgages.

And more homeowners have safer loan products, such as the 30-year fixed, as opposed to an interest-only loan or something else that’s potentially high-risk.

Affordability Is a Problem No Matter How You Slice It

While the existing stock of homeowners has never been better, thanks to those aforementioned rules and the low, fixed interest rates they hold, it’s a different story for prospective buyers.

Today’s home buyer is looking at an average mortgage payment that is 52% higher than the average apartment rent, per a CBRE analysis.

This is the worst premium since at least 1996, and even well above the prior housing market peak in 2006 when it stood at 33%.

If you look at the chart above, it’s basically all because of the sharp rise in mortgage rates, which increased from sub-3% levels to around 8% today in less than two years.

That’s unprecedented movement, even if rates remain below 1980s mortgage rates. The bigger takeaway is the speed at which rates climbed higher.

We’re talking a near-200% increase in rates in less than 24 months. Meanwhile, home prices haven’t come down, thanks to a dearth of supply.

And a phenomenon known as the mortgage rate lock-in effect, where existing homeowners with 2-3% mortgage rates feel trapped.

Or are simply unwilling to move and take on a much higher interest rate.

Taken together, we have the worst home buying affordability in 30+ years history.

That buy versus rent premium is also up from 51.1% during the second quarter and 45.3% a year ago.

Again, this is largely due to higher mortgage rates, which have continued to climb higher throughout the year thanks to a stronger-than-anticipated economy.

It Now Takes Over a Decade to Break Even on a Home Purchase

Thanks to the big price tag on a home purchase these days, combined with high mortgage rates, it now takes over a decade to break even, per new data from Zillow/Axios.

The typical home buyer who puts down 3% on a $376,000 home purchase with a 7.045% mortgage rate won’t reach this point for 13.5 years.

This assumes a typical increase in home values, 3% closing costs, 1% in home maintenance fees, along with 6% closing costs and 6% agent commissions paid at time of sale.

In other words, you won’t be able to turn a profit until you’ve been in it long enough to whittle down the balance to offset all the associated costs.

Using that same purchase price, the loan balance would be about $285,000 after 13.5 years of regular monthly mortgage payments.

If the mortgage rate was 3%, the balance would be roughly $240,000 at that time because a lot more of each payment goes toward principal.

Someone who puts 20% down on a house can break even a bit sooner, at around 11.3 years, which is still about double the five-year timeline.

What does this say. That maybe it’s not a great time to buy a home, at least from an investment standpoint.

See: Rent vs. buy calculator

Should You Wait to Buy a House?

At this juncture, I don’t think anyone would call you crazy for pumping the brakes on a home purchase, though everyone has different reasons for buying.

And over time when you bought can matter less, assuming you stay the course (ask the 2006 home buyers who still own).

Aside from housing affordability being at multi-decade lows, the available inventory of homes is also quite poor.

Simply put, there isn’t a lot to choose from at the moment, and affordability stinks to boot.

At the moment, there are only about 2.5 months of supply at the existing sales rate, about half the normal 4-5-month level of for-sale inventory, per Redfin.

So despite the horrible lack of affordability, home prices are holding up just fine. In fact, the median sales price is up 1.9% from a year ago.

In other words, if you’re a prospective home buyer today, you might be looking at slim pickings, intense competition from other buyers, and an 8% mortgage rate.

That sure doesn’t sound like favorable home buying conditions.

Those who bought last year and more recently may have been told to marry the house and date the rate.

The argument is the house can be yours forever but the interest rate doesn’t have to be. The problem is mortgage rates have continued to go up.

So that advice hasn’t panned out so well for those who bought banking on refinancing to a lower rate by now.

This means if you do buy a home today, you need to be prepared to pay the mortgage rate you’re given.

Not a temporary buydown rate or a potentially lower rate in the future that may not materialize.

One compromise might be a hybrid adjustable-rate mortgage, which is fixed for the first five or seven years.

By then, hopefully mortgage rates drift over. If you believe the forecasts, they’re actually expected to drop by 2024. But that’s subject to change. And there’s still the question of just how much.

One worry along these lines is lower mortgage rates could be accompanied by lower home prices. And that could make it difficult to refinance if the mortgage is underwater.

In other words, if you buy today, you better be able to afford it. And you better really like the house.

Read more: 10 reasons to buy a house other than for the investment

Source: thetruthaboutmortgage.com