This article originally appeared on RickOrford.com and has been republished here with permission.

Car owners throughout the U.S. almost always need to have a car insurance policy. With the financial considerations involved and the risks drivers face on the road, it’s important to weigh the cost of car insurance carefully. Do you think your car insurance is too high? If so, you can find cheap car insurance by shopping around.

In certain ways, your car insurance costs may be a reflection of you and your driving habits. Auto insurance providers often base the rates they charge on important factors. Some of these include your credit score, where you live, your driving record, and the type of car you drive. Therefore, if your premiums recently shot up or seem too high, you need to determine the possible reasons for it.

Reason #1: You Have Bad Credit

In most states, auto insurance companies use your credit score when calculating your car insurance premiums. Therefore, if you have a poor credit score, you may end up having to pay higher insurance premiums. However, the cost increase may depend on the auto insurance provider you choose and where you live.

According to the Insurance Information Institute, credit-based insurance scores are confidential ratings based on the insured individual’s credit information. Many insurance providers use credit scores in combination with other factors to help determine premiums. This is typically the case for insurance lines such as personal car insurance.

Reason #2: Poor Driving Record

Before giving you a car insurance policy, all insurance providers will want to know your complete driving record. This includes your traffic violations and accidents you had in the past. Even if the handful of accidents you had did not happen recently, you might still have to pay higher insurance premiums. The same applies to traffic violations.

However, if you have a clean driving record, you should enjoy lower insurance premiums. When it comes time to renew your policy, your insurance provider will check your driving record for DUIs, accidents, speeding tickets, and other traffic violations.

Your premiums may increase by as much as 20% after a speeding ticket. A DWI or DUI will cost you significantly more. You will also have to pay steep fines and attorney fees, in addition to an average premium increase of up to $800.

The reason for this difference in rates is that drivers with poor records are more likely to make more claims in the future.

Reason #3: Coverage Levels and Types

The type of coverage you choose and the level of insurance you have can greatly influence your insurance rates. Every state decides its own rules and requirements for minimum coverage requirements on any type of policy.

For example, some states have basic minimum requirements for property damage and bodily injury coverage. Others require additional coverages such as underinsured and/or uninsured motorists and personal injury protection or medical payments coverage.

A state like South Carolina, for instance, requires drivers to carry the following:

- A minimum coverage of $25,000 per person for bodily injury

- $50,000 per accident

- $25,000 in uninsured motorists’ coverage and property damage coverage within the same limits

Since the minimum requirements for drivers differ by state, you may start with different rates and coverages just on a basic liability insurance policy alone. Furthermore, if your car has a lien, you may need to have additional coverage or higher limits, which would affect your annual rates.

The answer to the question “Why is my car insurance so high?” may lie in the type of coverage you have. Generally, the more coverage your car has, the more you should expect to pay.

For example, do you have a full coverage insurance policy, which includes collision and comprehensive coverage? If so, it may cost you about 170% more in premiums than a policy with liability coverage only.

Reason #4: Your Claim History

Even if you only have a couple of accidents on your driving record, the resulting payouts will impact your insurance premiums. Of course, a driver with a couple of minor fender benders is a significantly lower risk than one who previously totaled several cars.

Whether the accidents were your fault or not, the number of claims you file will have an impact on your insurance rates. A no-fault accident can lead to a 10% increase in your premium and remain on your record for up to three years.

However, some states do not allow insurance providers to increase premiums after a no-fault accident. However, filing a claim for such an accident will still count towards your total number of claims.

Related read: How an Accident Can Affect Your Credit Score

Reason #5: Your Car

When setting premium rates, car insurance providers consider the type of car to be insured. Some types of cars are more likely than others to keep occupants protected in the case of an accident. This results in lower insurance rates.

However, drivers of high-powered cars such as sports cars are statistically more likely to drive recklessly. This makes these drivers more likely to cause accidents, resulting in higher insurance rates.

According to some studies, safer and bigger cars, such as small SUVs and minivans, tend to have the most reasonable rates of insurance. Smaller cars, on the other hand, have surprisingly high rates. One reason for this could be because they tend to sustain more extensive damage in a crash.

Reason 6: Where You Live

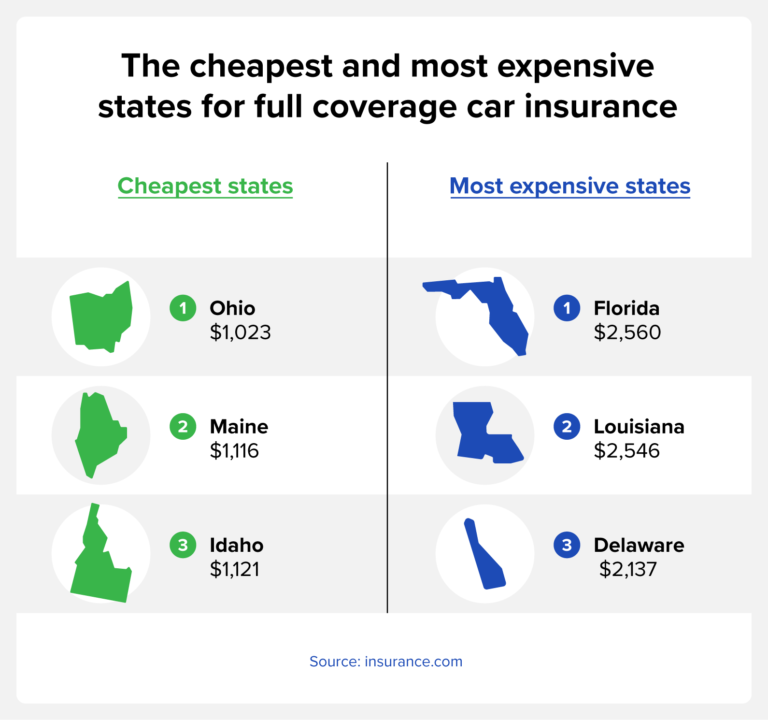

Car insurance costs vary widely across the United States. If you reside in Michigan, one of the most expensive states for auto insurance, you can expect to pay several times more than people living in Maine, for example.

Various factors affect insurance rates in each state. These include the number of uninsured drivers, condition of the road network, minimum coverage amounts, and more. That said, you need to understand that insurance rates can vary within a state or city as well.

For example, if you live in an area with narrow roads that frequently lead to accidents, you may have to pay more for insurance than you would if you lived elsewhere. Those who live in areas with high rates of auto thefts tend to pay more for car insurance as well.

Reason #7: Your Age or Gender

“Why is my car insurance so high?” This is a question many younger drivers tend to ask. According to the Insurance Information Institute, mature drivers tend to have fewer accidents than less experienced drivers, especially teenagers. This is the reason less experienced drivers pay more for car insurance.

Also, your insurer will charge you more if you let teenagers and young adults below 25 drive your car. If you have young drivers on your insurance policy, you may end up paying higher premiums.

Your gender may also affect how much you pay for car insurance. Statistically, men tend to get into more accidents and have more DUI-related accidents. Furthermore, they tend to have more serious accidents than women. These are the reasons why women tend to pay less for car insurance than men.

Young men are likely to pay a lot more for auto insurance. A 20-year-old man, for example, may have to pay about 16% more on his insurance premium than a woman of the same age.

However, as drivers age, the difference in rates tends to even out. Often, older women pay slightly more for car insurance than men of the same age. However, in this case, the difference in rates is quite small.

Reason #8: Your Insurance Company

Your car insurance may be expensive because your insurance provider charges higher rates. Rates vary dramatically among different insurance providers. Therefore, you could be paying significantly more than necessary.

According to one study, among the top ten auto insurance providers nationwide, the average price of basic coverage for a good driver is about $440 for six months. However, that same driver could be paying just $309 from one company or as much as $625 from another of the top companies.

Therefore, if you have a good driving record, you could save up to 51% in insurance savings by switching companies.

Reason #9: Your Driving Patterns

Simply put, you and your insurance provider are at higher risk the more often you’re on the road and the further you drive. If you travel great distances to and from work, driving your car may eliminate some of the inconvenience. You just listen to your favorite music or podcasts to pass the time as you drive to work every day.

However, you may be paying a higher insurance premium for that convenience. When you apply for insurance coverage, your insurance provider will want to know where you work and where you live. This will help them have a better idea of how far you drive regularly.

Reason #10: You Have Low Deductibles

When buying car insurance, car owners typically choose a deductible. This is the amount they would need to pay before the insurance provider picks up the tab in the event of theft, an accident, or any other type of vehicle damage.

Depending on the type of policy you choose, your deductibles may range from $250 to $1,000. However, there’s a catch. Generally, the lower your deductibles are, the higher your annual insurance premium is.

Reason 11: You Pay for Coverage You Don’t Need

If you think your car insurance is too costly, you need to take a closer look at your policy. Do you need to pay for things such as car rental coverage and roadside assistance? Although such coverage can provide some convenience, they are not the most important things to pay for.

Reason #12: You Have Gaps in Your Car Insurance

Many auto insurance companies consider the continuity of a car owner’s auto insurance. If you’ve had lapses or gaps in your car insurance history, you may be pegged as a high-risk car owner. As a result, your premium rates may increase by as much as 8% per year. The rate increase goes up to 35% if the coverage lapse extends beyond 30 days.

These penalties may also vary depending on your auto insurance provider. Make sure you ask your provider about how an insurance lapse would affect your premium rates.

The Bottom Line

To find out why your insurance rates seem to be expensive, you must first understand how auto insurance companies determine your rates. Fortunately, in most cases, you can do something about your unnecessarily high car insurance premiums. This may involve adjusting your driving habits or filing fewer claims, if possible.

In addition to shopping around for the best auto insurance rates and the right policy, you should look for discounts as well. These discounts may be applicable to drivers with good records, student drivers, and members of the military. Check your provider’s website to determine the types of discounts they offer.

The more information you have, the easier you can identify the factors contributing to your car’s high insurance rates.

Source: credit.com