Apache is functioning normally

Yes, you can refinance student loans with a private lender more than once in the quest for a lower interest rate and different repayment term.

How Many Times Can You Refinance Student Loans?

If you’re a graduate who has the credit score and income to qualify, you can refinance your student loans as many times as you’d like. In fact, some folks refinance multiple times.

But before you get too refi-happy, it’s important to know the advantages and disadvantages of this strategy.

What Are Some Advantages of Refinancing Multiple Times?

One of the biggest advantages of refinancing your student loans is that you may be able to qualify for a lower interest rate, whether you refinance once or several times. A reduced rate can help you save money in the long run.

For example, let’s say you’ve been paying down an older federal Grad PLUS loan that currently has a balance of $40,000 and an interest rate of 7.90%. You have 10 years of payments left, which are currently $483.20 per month.

You have good credit and qualify for a seven-year, fixed refinance rate of 6%. If you were to go through with the refinance, you’d actually increase your monthly payment by about $100. However, you’d save about $8,900 in total interest.

Later on, you might qualify for a lower fixed rate or an even lower variable rate, and so on.

Or you might find it helpful to refinance to a longer term, with lower monthly payments. That will likely mean paying more in interest over the life of the loan, but lower monthly payments may put you in a better position to accomplish your short-term financial goals.

Reputable lenders charge no application or origination fees, so refinancing each time will not cost you anything.

💡 Quick Tip: Get flexible terms and competitive rates when you refinance your student loan with SoFi.

What Are Some Disadvantages of Refinancing Multiple Times?

One disadvantage of refinancing your student loans is that your credit score could temporarily drop by a few points. Whenever you apply for a loan, the lender performs a hard credit inquiry. One or two inquiries usually have a small and temporary impact on your score. However, too many hard inquiries within a short time frame could cause some damage. The good news is that many student loan refinancing lenders allow you to shop for rates and get quotes online using a soft credit pull, which has no impact on your score.

Another factor to consider is your time. Though you can refinance as many times as you want, it helps to make sure it’s worth the effort. That means researching reputable lenders and the rates and terms they offer.

It’s important to point out that refinancing federal student loans even once will cause you to permanently forfeit government-backed protections and benefits, such as federal student loan forgiveness programs, deferment, and forbearance.

How Is Student Loan Refinancing Different Than Consolidation?

It’s important to make a distinction between refinancing and consolidation. When you refinance your student loans with a private lender, you are borrowing one new loan with new terms, such as a lower interest rate or different repayment term, and using the proceeds to pay off your existing loans.

When you consolidate federal student loans into a Direct Consolidation Loan, you combine your existing loans into one. The term may be drawn out to up to 30 years, and the interest rate will be the weighted average of the original loans’ rates, rounded up to the nearest eighth of a percentage point. For this reason, your new rate may actually be higher than the rate of your previous lowest-interest loan.

Things to Look for When Refinancing

Whether you refinance your student loans for the first or sixth time, it would be smart to check that your new rate and term make sense for you.

You’ll encounter fixed-rate and variable-rate loans. Fixed-rate loans have one set interest rate that does not change over the life of the loan. The rates on fixed-rate student loans are typically higher than the initial rates of variable-rate loans. However, because the rate never changes, it can make budgeting easier.

Variable-rate loans have interest rates that start off lower, but can fluctuate based on the prime rate or another index. Rates can climb if the rate or index they are tied to goes up (and vice versa).

Variable-rate loans might be a good choice for shorter-term loans. The longer the loan term, the bigger the chance of a rate hike.

Also, beware of qualifying for a low interest rate that’s attached to a longer-term loan. Though monthly payments might be low, a longer term might mean you’ll end up paying much more in interest over the life of the loan. If you can afford the higher monthly payment, loans with shorter terms can be a good cost-saving option.

Consider looking for a refinance lender that offers competitive rates and flexibility in choosing the repayment term. And if you want to refinance both federal and private student loans into one new loan, look for a lender that does that.

Serious savings. You could save thousands of dollars.

We offer flexible terms and low fixed or variable rates.

Refinancing Your Student Loans More Than Once

It’s all about the great rate chase.

Having a low debt-to-income ratio can help you qualify for a lower interest rate. So if you have a higher salary, get a big bonus, or pay off other debts, your debt-to-income ratio might improve.

Similarly, if your credit score increases, you typically become more attractive to lenders. This could happen if you are using a small amount of your available credit, or if you find and correct a mistake on one of your credit reports. (Do student loans affect your credit score? Continuous on-time payments may have a positive effect.)

Married couples may want to consider refinancing student loans together to put the power of two earners to use. A solid cosigner could also be brought aboard.

If you’re thinking about a refinance, it could help to keep an eye on the federal funds rate, which is the rate banks charge one another for overnight loans. When the Federal Reserve raises or lowers short-term interest rates, private lenders respond in turn. (This does not apply to federal student loans, whose interest rates have been set by Congress once a year since 2006.)

Even if interest rates rise now, they could still be considered low by historical standards.

Refinancing Your Student Loans With SoFi

Is it bad to refinance multiple times? If it saves you money, that’s nothing but a good thing. Refinancing won’t be the right move for all people, but everyone should know the rates they’re paying, their total student debt load, and their repayment strategy.

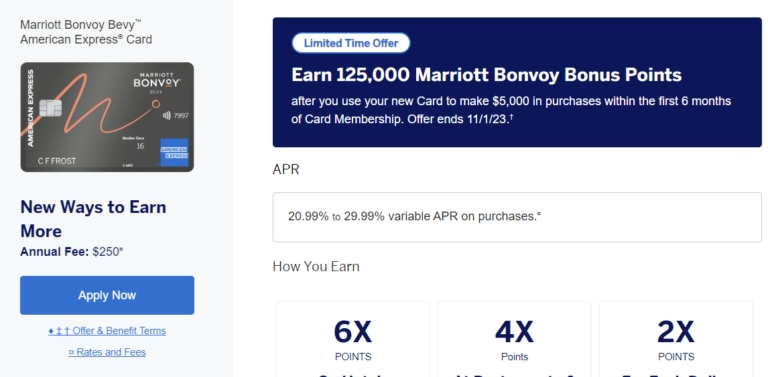

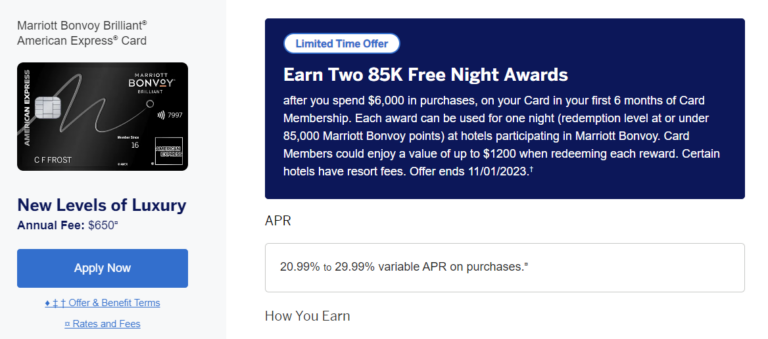

SoFi is a leader in refinancing student loans, with low fixed or variable rates and flexible loan terms.

Looking to lower your monthly student loan payment? Refinancing may be one way to do it — by extending your loan term, getting a lower interest rate than what you currently have, or both. (Please note that refinancing federal loans makes them ineligible for federal forgiveness and protections. Also, lengthening your loan term may mean paying more in interest over the life of the loan.) SoFi student loan refinancing offers flexible terms that fit your budget.

With SoFi, refinancing is fast, easy, and all online. We offer competitive fixed and variable rates.

FAQ

Can I consolidate student loans more than once?

You can consolidate federal student loans into a Direct Consolidation Loan more than once only if you have federal loans that were not included in a previous consolidation, or if you previously consolidated loans under the Federal Family Education Loan (FFEL) consolidation program. Remember that consolidation does not lower your loan rate.

How many times can you refinance a loan?

As many times as you qualify to do so.

How many times can you take out student loans?

When it comes to federal student loans, there is no time limit on how long a borrower can receive Direct Unsubsidized Loans or Direct PLUS loans, but annual and aggregate limits for Direct Unsubsidized Loans apply.

Private student loans, for which you must qualify or have a cosigner, usually have an annual limit equal to an institution’s cost of attendance minus other financial aid. Most have aggregate loan limits for undergraduate and graduate students.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Student Loan Refinancing

If you are a federal student loan borrower you should take time now to prepare for your payments to restart, including the opportunity to refinance your student loan debt at a lower APR or to extend your term to achieve a lower monthly payment. (You may pay more interest over the life of the loan if you refinance with an extended term.) Please note that once you refinance federal student loans, you will no longer be eligible for current or future flexible payment options available to federal loan borrowers, including but not limited to income-based repayment plans, such as the SAVE Plan, or extended repayment plans.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOSL0823017

Source: sofi.com