Apache is functioning normally

How High Could CD Rates Go in 2024?

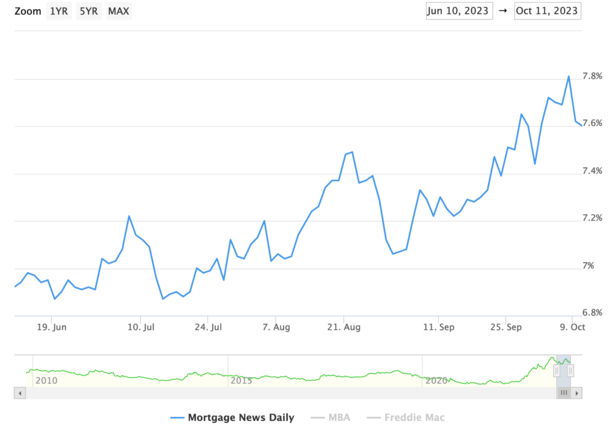

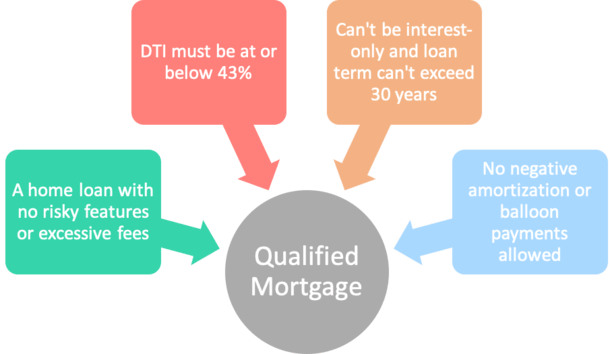

Wouldn’t it be great if we all had a crystal ball that told us what the interest rate environment would do? We could figure out the best time to get a mortgage or the best time to buy a car. And of course, we would know exactly when to put all of our money into certificates of deposit (CDs) to maximize our yield.Unfortunately, that isn’t the case. Nobody knows what interest rates are going to do in the future — not even the people in charge of setting benchmark interest rates. However, we can use the latest economic projections to consider the most likely scenario and what else could happen instead. So here’s what we know (and don’t know) about what CD yields will do in 2024.Where do CD yields come from?The short explanation is that CD rates are a combination of three main factors:The current interest rate environmentThe bank or financial institution that offers themThe maturity termIn other words, when benchmark interest rates rise, CD rates generally tend to rise along with them. However, the rates paid by CDs can vary dramatically between banks.For example, as I write this, our top 12-month CDs have APYs ranging from 4.25% to 5.65%. The same is true for CDs of other maturity lengths as well. But because the Federal Reserve has raised benchmark interest rates so aggressively in the past couple of years, this range is significantly higher than it was.When it comes to different maturity lengths, it’s a little tricky to explain, but the general idea is that shorter-term CDs tend to track benchmark interest rates rather closely. The current federal funds rate (the most important interest rate the Fed controls) is set to a range of 5.25% to 5.5%, and this is certainly aligned with most of the top 1-year CDs we track.With longer maturities, there are a lot of economic factors at work, but the simple explanation is that CD yields are a combination of the current interest rate environment and expectations for future interest rate movements. In most environments, longer-maturity CDs tend to have higher yields, since banks typically pay a premium if customers agree to leave their money on deposit for a longer time. But as of Oct. 2023, the range of 5-year CD yields on our top CD list is 3% to 4.85%, with the average yield significantly lower than the average 1-year CD.This makes sense. According to the latest projections from the policymakers at the Federal Reserve, the benchmark federal funds rate is expected to fall to 4.6% by the end of 2024 and to 3.4% by the end of 2025.What will CD rates do in 2024?There’s no way to predict with accuracy what CD rates will do next year. Even the Federal Reserve’s own projections can be very wrong. In fact, the Fed’s projections in Sept. 2021 called for a federal funds rate of just 1% at the end of 2023.Having said that, the latest projections call for one further quarter-point rate hike by the end of 2023, which would likely push CD yields slightly higher to start 2024. And if the Fed’s projection of a 4.6% federal funds rate proves to be accurate, we could expect 1-year CD rates to gravitate towards that level, with other maturity terms drifting generally lower as well.However, it’s tough to overemphasize that we don’t know what is going to happen. If inflation proves far more difficult to control than the Fed expects, it’s entirely possible that several more interest rate hikes will be needed and CD yields will be much higher at the end of 2024. On the other hand, there’s the possibility of a recession coming and the need for the Fed to aggressively cut rates if the economy takes a worse downward turn than expected.The bottom line is that CD rates are higher right now than they’ve been in a long time, and the best course of action is to put your money in CDs that make sense for you now — not to leave your cash on the sidelines in anticipation of rates rising even further.However, one smart strategy could be to create a CD ladder, which gives you the best of both worlds. If rates end up rising in 2024, you’ll end up with some money to take advantage. And if rates fall, most of your money will be locked in at today’s rates.

Costco Is Selling a Full Thanksgiving Meal Kit So You Don’t Have to Do a Thing

By: Maurie Backman |

Updated

Oct. 23, 2023 – First published on Oct. 23, 2023

Some people absolutely love hosting Thanksgiving and getting creative in the kitchen. But if you’re someone who dreads Thanksgiving and the hours upon hours of preparation that tend to come with it, then you may be in luck. Costco is selling a Thanksgiving meal kit for $199.99 that’s designed to feed a party of eight. You’ll need to pre-order yours by Nov. 5, but it could be worth it for the time-related savings involved. And you may even find that Costco’s Thanksgiving dinner kit saves you money, too.When you’re looking to outsource your Thanksgiving mealEven if you’re someone who likes to cook, being in charge of Thanksgiving isn’t easy. There’s a lot of pressure to throw together a massive feast, and you may not have the time or desire to spend an entire day preparing food. If you’re not at all looking forward to a day of cooking, let Costco come to your rescue. For $199.99, you’ll get the following:Five pounds of skin-on turkey breastA two-pound tray of stuffingA 1.5-pound trap for mashed potatoes with a side of gravyA 1.6-pound tray of macaroni and cheese A two-pound pack of sweet cornA two-pound pack of green beansCranberry relish12 dinner rollsOne pumpkin pieOne apple pieAll of this food will ship frozen, and you can expect delivery to your home between Nov. 8 and 17. Will Costco’s Thanksgiving meal kit save you money?You probably won’t save money by purchasing Costco’s meal kit compared to buying ingredients for the above dishes at Costco, or even elsewhere. At your local grocery store, turkey might cost about $3.50 per pound. So a five-pound turkey might cost you just $17.50. A Costco pumpkin pie, meanwhile, is generally only $5.99 (though prices can vary). So right there, you’re looking at $23.50 for 20% of your meal. The cost of the other items included in Costco’s Thanksgiving dinner kit can vary based on how you prepare your sides. But macaroni and cheese, for example, can be an extremely inexpensive dish to prepare. A single box of Kraft might cost under $1.50, so even if you need five boxes, you’re looking at $7.50 or less in total. (Of course, if you insist on making yours from scratch with high-end cheese, that’s a different story.)All told, you can probably throw together a Thanksgiving meal for eight for under $200 — but not so much under. So the question you’ll want to ask yourself is how much time you want to save.Also, if you’re so not looking forward to cooking to the point where you think you’ll pay to cater your Thanksgiving dinner, then you’re likely to put more than $200 on your credit card by going that route through a local restaurant or caterer. In that regard, Costco’s offering could save you some money.All told, Costco’s Thanksgiving dinner kit may be worth considering if you’re not excited to cook for the holiday this year. But chances are, this meal kit is going to be a popular item, which means it may sell out soon. If you are interested in ordering it, do so quickly so you don’t miss out.

3 Costco Perks You Aren’t Taking Advantage of — but You Should

By: Brittney Myers |

Updated

Oct. 23, 2023 – First published on Oct. 23, 2023

Just $250 a month at Costco would earn enough back to pay for the upgrade. In other words, if you spend more than $250 a month at Costco, upgrading makes financial sense.If that sounds like a ton of money to you, then definitely stay with your regular membership. But if your family goes through Kirkland Signature toilet paper like they flush it down the toilet, and you’re one of the people who actually finishes that 3-liter bottle of olive oil, then a membership upgrade could be a smart idea.Double up with rewards cardsWhether an Executive membership is right for you or not, there’s another way to earn rewards that everyone should be taking advantage of: rewards credit cards.Unfortunately, you can only use Visa credit cards in a Costco warehouse. If you’re shopping at Costco.com, you can use Visa or Mastercard credit cards. While these restrictions certainly stymie some of my favorite rewards cards, you’re not completely out of luck. There are still some great options from either issuer. Costco even offers its own cobranded Visa card, which can be especially rewarding when it comes to gas purchases. I prefer to use my Chase Freedom Unlimited®, however, for 1.5x points per $1.

I Bought a $278.99 Walmart Mattress. Here’s How It Compares to My Expensive Tempur-Pedic

By: Christy Bieber |

Updated

Oct. 27, 2023 – First published on Oct. 27, 2023

Recently, we bought a mattress that we plan to use temporarily for a few months as most of our furniture is in storage while we complete a remodeling project. We didn’t want to spend a lot of money since this mattress will be relegated to a guest room, if it is used at all, once we get our furniture back in place.We opted to buy a memory foam mattress from Walmart and paid $278.99 for a king size. This was a fraction of the cost of our regular mattress, which is a Tempur-Pedic that cost several thousand dollars.After sleeping on the cheap mattress for a while, here’s how they compare.Both are equally comfortableFirst and most importantly, my husband and I have found that both of the mattresses are equally comfortable to sleep on. Both provide a similar level of firmness and support. And, we don’t feel the other person moving around in either bed. In fact, if forced to pick which of the two we like better, we would not be able to based on the comfort factor alone.Both have the same warrantyOur Tempur-Pedic mattress came with a 10-year warranty. We didn’t expect our new bed to offer this same guarantee since it cost so much less. But, we were wrong. The new, inexpensive mattress also has a 10-year warranty and a 30-day refund policy to make sure we’re comfortable with it.Both have multiple layersOur Tempur-Pedic came with multiple different layers of material including a comfort layer on the top, a support layer in the middle, and a base layer. Each of these layers is supposed to serve a purpose, like distributing body weight evenly along the mattress or dispersing heat.Our inexpensive mattress actually comes with more layers, referred to as the “five floors of comfort.” There’s a top breathable fabric, a second layer to avoid heat, two separate support layers, and a non-slip layer at the bottom.I’m not exactly sure if all of these layers are serving their exact purpose, but I have noticed that neither bed sleeps warm and both feel like they provide adequate support. The non-slip layer on the cheaper mattress also seems to help it stay in place on my box springs.The Tempur-Pedic feels heavier and more substantialThe Tempur-Pedic stands out by feeling more substantial. The cheaper mattress came vacuum packed in a tiny little package and it took a while to fluff up. And it just doesn’t have the same heft as the Tempur-Pedic mattress.However, while this is a point in the Tempur-Pedic’s favor because the substance has me feeling like it may last longer, it also means the Tempur-Pedic is more of a pain to move around.Ultimately, I feel like the cheaper mattress was a better buy. It left more money in my bank account than the Tempur-Pedic, and it provides a similar level of comfort as well as the same warranty.The experience has shown that buying a more expensive bed isn’t always the best option, so before breaking out your credit cards, be sure to explore and fully compare different mattresses to find one that feels the best at a fair price. Visit some stores and try them out. Don’t immediately dismiss one just due to a lower price point, as you might miss out on a comfortable mattress at a great discount. And don’t forget to consider the return policy and warranty so you end up happy with your purchase in the long run.

Mark Cuban Thinks You Should Buy a 2-Year Supply of Toothpaste. Here’s Why

By: Christy Bieber |

Updated

Oct. 27, 2023 – First published on Oct. 27, 2023

Mark Cuban is the owner of the Dallas Mavericks and is well-known for his business skills and investing prowess. Over the years, he has provided some tips to others who want to get rich, and one of them was a pretty surprising one.His advice: Buy a two-year supply of toothpaste. Here’s why the billionaire suggested making this unconventional move.Cuban has a simple reason for buying so much toothpasteMark Cuban doesn’t just want your teeth to be really clean. He had a good reason for suggesting purchasing such a large stockpile. Specifically, he advised doing this if you use the same brand of toothpaste regularly and can find it at a deep discount.”If we, hopefully we’re all using toothpaste every day, right, couple times a day, and we’re gonna go through toothpaste every month, whatever it may be, you’re better off buying two years’ worth of toothpaste when it’s on 50% discount,” he said. “That’s an immediate return on your money.”Cuban’s point was that the prices of items go up over time, so you’re better off purchasing them at the lowest possible price as this puts guaranteed money in your pocket. You also immediately benefit from the savings since you get to spend less now and in the coming years, keeping more cash in your bank account.Toothpaste isn’t the only item Cuban believes you should stock up on. “Any of your reusables, consumables that you have to have, when they’re on a huge sale on Amazon, buy them, because chances are, their prices are gonna go up, but that’s a real savings that you get to put in your pocket.”Cuban said that while it can feel difficult to make a profit by investing in a brokerage account, this is a simple step that anyone can take that will have an immediate positive impact on their personal finances.Should you follow Cuban’s advice?Listening to Cuban just makes good sense — especially as the recent few years of rising prices and surging inflation have demonstrated that routine products and services that we use every day can and do see big price increases.If you’re able to get many of your consumer products at discounted prices, this can make a noticeable difference in your personal finances. It’s not difficult to do either. Most stores put items on sale on a predictable schedule, such as marking down a product once every six or eight weeks. If you can stock up when there’s a good price — and especially if there’s a deep discount, then you’ll be able to slash what you spend on groceries and personal care.Use this extra money wisely to do things like repay debt or invest for your future, and you will end up being able to build wealth without changing your lifestyle at all. But, no matter what you do with the money, you probably have better stuff to spend it on than paying full price for toothpaste.

Source: fool.com