Apache is functioning normally

Inside: Do you want to claim your partner as a dependent on your taxes? This guide will explain the rules of claiming dependents whether girlfriend or boyfriend and help you take the necessary steps to do so.

Navigating the waters of tax credits can be tricky, especially when it involves claiming an unmarried partner as a dependent.

The Internal Revenue Service (IRS) does permit the declaration of a non-relative adult as a dependent, provided certain conditions are met.

And that is where it gets tricky for the tax novice.

That is where we are going to reference the IRS guidance, so you can determine whether or not you qualify for this deduction.

By pointing you in the right direction, you can understand the specific tests and requirements to avoid any tax-related complications.

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

Understanding dependency in the context of taxes

The word “dependent” might remind you of a newborn baby or an elderly family member. But in tax terms, the meaning broadens.

In the IRS terms, a “dependent is a person, other than the taxpayer or spouse, who entitles the taxpayer to claim a dependency exemption.” 1

This might be a child, an adult family member, a significant other, or even a close friend. This term “qualifying relative” is crucial in IRS parlance for its implications on your tax dues.

Typically, any person can qualify as a dependent if more than half of their financial support, including living and medical expenses, is taken care of. Also, it’s an opportunity to boost one’s tax return by up to $500 with the Other Dependent Tax Credit.

What qualifies a person as a dependent?

The IRS bases dependents on two categories: “Qualifying children” and “Qualifying relatives.”2 You might think of a qualifying child as your son or daughter. Expanding the scope, a qualifying relative can be a sibling, a parent, or even a significant other.

The essence lies in their financial reliance on you and the nature of your relationship. They ought to:

- Be related to you via blood, marriage, or adoption;

- You provide over 50% of their financial support including housing, food, medical care, and other expenses

- They are U.S. citizen.

- The income of the possible dependent.

These nuanced rules might sound overwhelming, but IRS guidance and tax experts like TurboTax can help lighten the load.

Now, let’s address this sticking point: Can you actually claim your partner as a dependent? The following section unravels the mystique.

TurboTax

TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with 100% accuracy.

This is how I have filed my personal taxes for many years.

Get Started

Can I Claim My Partner as a Dependent?

You can claim your partner as a dependent on your tax return, provided they meet certain criteria explained by the IRS, including passing the non-qualifying child test, the citizen or resident test, the joint return test, the income test, and the dependent taxpayer test.

I know this is where it gets difficult to follow for the average person.

So, we are here, to break this terminology down into layman’s terms, as such you can then make the best decision for your tax situation.

If you are still confused, then consult with an online tax software like TurboTax or a tax professional for guidance on your personal taxes.

Basic requirements for claiming your partner as a dependent

This essentially means that your partner should be financially dependent on you, where you bear more than half of their living expenses.

In essence, claiming your partner as a dependent revolves around these fundamentals: 2

- Residency: Your partner must have been living with you for the full tax year.

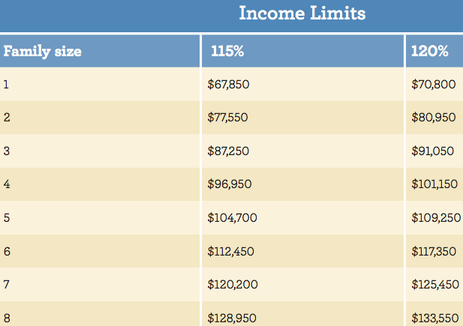

- Income limit: Your partner’s gross income should not exceed $4,700 for the year 2023.

- Support Requirement: You are the main pillar for your partner’s financial needs by covering over half of their total expenses.

- Anyone Else Claiming Them: None else should claim your partner as their dependent.

- Unmarried. Your partner must be unmarried legally.

All fulfillment of these criteria moves you a step closer to enjoying some tax relief.

Confirm with an accountant or tax expert as exceptions can exist, such as temporary absences due to illness, education, business, and others.

Common scenarios where you can claim your partner as a dependent

Claiming a partner as a dependent isn’t as fancy as it sounds, but it’s plausible. Here are common scenarios enabling you to do so:

- Co-habiting Before Marriage: You and your partner share a home, and you pay more than half of your partner’s living costs. However, your living situation cannot violate local laws, as in some states, “cohabitation” by unmarried people is against the law.

- Unemployed Partner: Your partner’s tie with working life is severed (e.g., due to health issues or being laid off), and you bear most of the living expenses.

- Supporting Student Partner: Your partner pursues their education, and you shoulder the majority of their expenses.

Take this interactive IRS quiz to determine whom I may claim as a dependent.

How much will I get if I claim my girlfriend as a dependent?

Now the pivotal question: what’s the advantage in dollars and cents?

In essence, claiming your partner as a dependent will slash your taxable income by $500 with the Other Dependent Tax Credit. 3

If you already qualify for Head of Household status with another dependent, then it is possible your deduction may be more. 4

Remember, there’s no one-size-fits-all answer. When tax complexities strike, consult an expert!

Is it better to claim my girlfriend as a dependent?

Honestly, like most tax questions, the answer is: it depends.

If you’re covering your partner’s majority expenses and they’re fulfilling all IRS criteria, then claiming them can bring solid tax savings.

Yet, bear in mind:

- If your partner earns substantial income (greater than $4,700), they might lose personal benefits by becoming your dependent.

- By claiming your partner, their Social Security or medical benefits may take a hit.

So, assess your partner’s income, benefit entitlements, and your tax situation. Then, tread wisely.

e-file

E-file makes tax season a breeze with its user-friendly interface, ensuring a seamless and stress-free experience for filers.

Simplify your tax journey by choosing E-file.

Start Now

Important Rules to Keep in Mind When Claiming Your Partner

When filing taxes, it’s crucial to understand that both parties are responsible for the accuracy of each other’s tax reporting and liability.

It’s worth noting that tax advantages and disadvantages exist in the scenario of being married and filing jointly, such as potential reductions in your tax bracket and sharing of business losses. So, it may be something to consider.

Can I claim my girlfriend as a dependent if she has no income?

In a nutshell, yes! If your girlfriend had no income in the tax year, you might claim her as a dependent. Given you provide over half of her total support and she lived with you all year, you’re golden.

For 2023, your partner’s gross income should not exceed $4,700.

However, keep in mind that in cases where public assistance or Social Security benefits are her primary financial sources, claiming her could negatively impact those benefits.

Learn the answer to do you have to file taxes if you have no income.

Remember: tax waters are often murky. When in doubt, lean on a tax professional’s shoulder!

Support factors

Answering the support question plays a hefty role in determining who qualifies as a dependent.

You shouldn’t just share the living cost; you should pay more than half of it. Remember, it includes an array of expenses, like food, clothing, education, or medical expenses.

The implication of your partner being claimed by someone else

Here’s a key rule: if someone else is claiming your partner as a dependent, you’re out of the game. The IRS rules say a person can be claimed as a dependent by only one taxpayer in a single tax year.

- This could happen if your partner perhaps lives part of the year with someone else like a parent.

- Another possibility is if your partner is legally married still, then they would have to file a married, filing separately return.

So, if your partner qualifies as someone else’s dependent, even if they don’t claim them, you can’t claim your partner.

Frequent Situations Where You Can’t Claim Your Partner as a Dependent

Considerations for Non-resident or Non-citizen partners

If your partner isn’t a U.S. citizen, resident, or national, the dependent claiming game changes. Notably, nonresident aliens cannot be claimed as dependents.

However, if your partner is a resident of Canada or Mexico or a U.S. national, you may claim them. But they should be living with you full-time. 2

This rule extends to partners awaiting changes in their residency or citizenship status. In such cases, you must wait until their status changes before claiming them.

When your partner earns more than the stipulated income threshold

When your partner’s income level sails past the IRS limit ($4,700 in 2023), claiming them as a dependent slips off the table. 2

Any part-time job, seasonal work, or income source counts, even those seemingly negligible. As soon as they cross this threshold, regardless of how heavily they rely on you or where they reside, they can’t qualify as your dependent.

Make sure to stay updated on IRS rules. They adjust the income limit for inflation annually, which changes this income ceiling. Keep an eye peeled for those IRS updates!

TurboTax

TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with 100% accuracy.

This is how I have filed my personal taxes for many years.

Get Started

How to Officially Claim Your Partner on Your Taxes

To officially claim your partner as a dependent on your tax return, you will do this when you file your taxes.

Thankfully, this is made easier with online software companies like TurboTax or H&R Block.

The same is true when you are trying to figure out how to file taxes without a W2.

Necessary steps to claim your partner on your taxes

You will first identify them as “other qualifying dependent” or “other qualifying relative”.

- Gather the facts first: Confirm your partner’s income, residency, and who has been supporting them for more than half the year.

- Document expenses: Keep track of all relevant bills and receipts to demonstrate your majority support.

- Use tax software or a professional: Follow prompts about dependents in tax software like TurboTax. They could guide you through the process and specifics.

- Complete relevant Tax Forms: Prepare the necessary forms such as Form 1040 and Schedule H and have proof of residency, financial support, gross income information, and certification of your domestic partnership to support your claim.

- File your return: Don’t forget to include your partner’s details and tick the correct boxes.

Remember, the devil is in the details. So carefully evaluate your situation to avoid missteps, and consult with a tax professional when in doubt.

Pitfalls to avoid while filing tax returns

While preparing to file your tax returns, beware of these common pitfalls:

- Incorrect income calculation: Ensure you tally your partner’s gross income accurately. Reminder: it should not eclipse $4,700 in 2023.

- Overlooked Living Qualification: Your partner must have resided with you the entire year. Temporary absences (illness, education) can be exceptions.

- Ignoring Other Claimants: If someone else is poised to claim your partner as a dependent – even if they don’t – you can’t claim them.

- Emergency Funds Consideration: If your partner taps into their savings for a large expense, this could speak against you providing most of their support.

- Forgotten Documents: Maintain a record of bills, receipts, and other expense documents.

The IRS overlooks no mistakes, so take care and stay informed. When in doubt, professional tax help is a button away.

Frequently Asked Questions (FAQ)

Get Online Help

Navigating tax rules and regulations doesn’t need to be overwhelming. With the advent of online help, understanding whether you can claim your partner as a dependent becomes considerably more manageable. Here are a few benefits of seeking online help:

- Convenience: With online help, you can access the information you need anywhere, anytime. No need to schedule appointments or deal with traffic to get to a tax office. You can get the updates and instructions right from the comfort of your own home.

- Accessibility: Some great examples of accessible platforms are TurboTax, e-File, and H&R Block which provide 24/7 support and resources. They offer a wealth of information and experts at your fingertips.

- Expertise: Apart from the convenience, these websites employ tax experts who deliver professional analysis and guidance tailored to your specific needs. Specifically, you can use TurboTax Live Full Service for someone to do your taxes from start to finish. Or you can ask questions with TurboTax Live Assisted.

File your own taxes with confidence using TurboTax. This can greatly simplify the process and minimize potential missteps.

Now, Can I Claim my Unmarried Partner as a Dependent is Up to You

As they say, “Ignorance of the law is no excuse”. The same holds true for tax rules.

Falsely claiming a dependent can lead to severe penalties, not just a dinging of your wallet. You’d be sailing the choppy waters of tax evasion, which can bring on hefty fines or even dark days behind bars.

In blatant cases, the IRS could impose a Civil Fraud Penalty. That means a penalty amounting to 75% of the unpaid tax amount resulting from fraud. 5

In short, play by the rules! Accurate and clear tax filing may seem tedious, yet it will steer clear of any legal trouble. Remember, it’s always safer to ask if you are unsure!

Now, are you wondering why do I owe taxes this year?

Source

- Internal Revenue Service. “Tax Tutorial.” https://apps.irs.gov/app/understandingTaxes/hows/tax_tutorials/mod04/tt_mod04_glossary.jsp?backPage=tt_mod04_01.jsp#dependent. Accessed October 23, 2023.

- Internal Revenue Service. “About Publication 501, Dependents, Standard Deduction, and Filing Information.” https://www.irs.gov/forms-pubs/about-publication-501. Accessed October 23, 2023.

- Internal Revenue Service. “About Publication 501, Dependents, Standard DeductionUnderstanding the Credit for Other Dependents.” https://www.irs.gov/newsroom/understanding-the-credit-for-other-dependents. Accessed October 23, 2023.

- Intuit TurboTax. “Guide to Filing Taxes as Head of Household.” https://turbotax.intuit.com/tax-tips/family/guide-to-filing-taxes-as-head-of-household/L4Nx6DYu9. Accessed October 23, 2023.

- Internal Revenue Service. “25.1.6 Civil Fraud.” https://www.irs.gov/irm/part25/irm_25-001-006. Accessed October 23, 2023.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.

Source: moneybliss.org